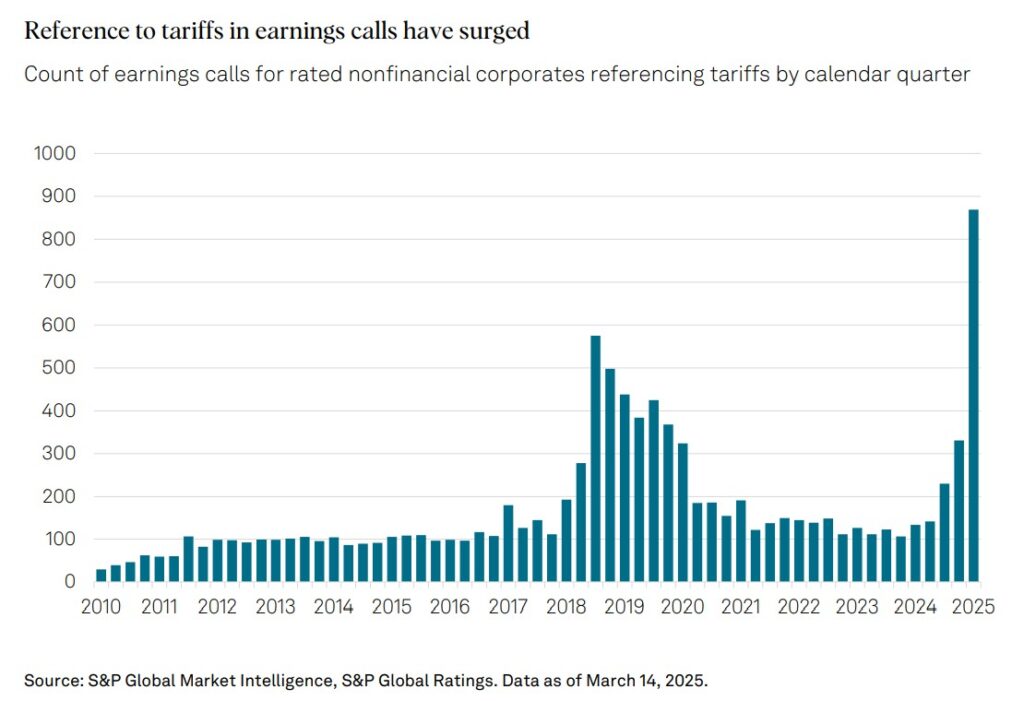

After nearly a month under the Trump administration’s renewed tariff regime, signs of economic strain are beginning to surface across US supply chains, inventories, and consumer sentiment. The lag effect of international shipping schedules means the real-world impact of “Liberation Day” is only just beginning to materialize.

Containerized imports from China, which still represent a significant portion of US inbound goods, have plunged by as much as 60 percent, according to industry trackers. Retailers are now bracing for rolling product shortages that could emerge as early as mid-May, with broader consequences unfolding into the summer and fall.

Historically, ocean freight between China and the US has taken between 20 to 45 days to arrive, which means goods ordered or canceled in early April are only now reaching or failing to reach US ports. The Port of Los Angeles has reported a dramatic increase in blank sailings (ships arriving empty) with a combined expected loss of over 350,000 twenty-foot equivalent units (TEUs) in May and June. These shipping disruptions have already begun reducing stock available for core retail categories, most notably toys, clothing, and seasonal goods. The Toy Association reports that 80 percent of toys sold in the US are sourced from China, and nearly 80 percent of mid-sized toymakers are canceling or delaying summer manufacturing orders. With holiday goods typically produced in spring for fall and winter delivery, the timeline for many of these products is now irrevocably disrupted.

Container Ship Tonnage (TEU) – Departures from China to the United States (white); Container Ship Count – Departures from China to the United States (blue); “Liberation Day” (red horizontal dash), 2024 – present (Source: Bloomberg Finance, LP)

(Source: Bloomberg Finance, LP)

Another early casualty is likely to be the “back-to-school” category. In categories like apparel, much of the low-end manufacturing has shifted to Bangladesh or Vietnam, but mid-market categories like coats, jackets, and knitwear remain heavily reliant on Chinese factories. Clothing retailers are now pausing orders, anticipating that new tariffs (in some cases as high as 145 percent) will make many Stock Keeping Units (SKUs) unprofitable. As a result, school-year shopping for uniforms, jackets, and children’s basics may encounter limited selections, significant price hikes, or both. Halloween and winter holidays could face even more pronounced shortages: seasonal decorations, party supplies, and giftable products, including dolls, electronics accessories, and low-cost gadgets, all of which are disproportionately sourced from China.

While electronics have thus far remained exempt, that too is in question. If tariffs are extended to those goods, even the carefully planned holiday doorbusters for televisions and gaming consoles could be derailed. Many big-box retailers have already submitted tentative purchase orders for these items, but they will need to be finalized soon to meet fourth-quarter demand. In response to growing uncertainty, some stores are reverting to pandemic-era inventory strategies: simplifying product assortments, prioritizing core SKUS with dependable margins, and reducing speculative or novelty offerings. Doing so may help preserve profitability, but it will come at the considerable cost of consumer choice.

Importantly, the impact is not limited to supply chain timing. The structure of the tariff itself – levied on the wholesale value at the port of entry – poses a particular challenge for small- and medium-sized firms, which generate over 80 percent of US employment. Those same firms often lack the capital reserves to absorb rapid cost increases or to pivot quickly to alternative suppliers. Some companies are exploring partial assembly or finishing of goods within the US to reduce tariff exposure, but as a workaround, that option is both capital- and labor-intensive, and in any event unlikely to be scalable within the next quarter or two. For now, many smaller firms are canceling orders outright, leading to a decline in new business activity, weakening earnings outlooks, and rising inventories of outdated or non-tariffed goods.

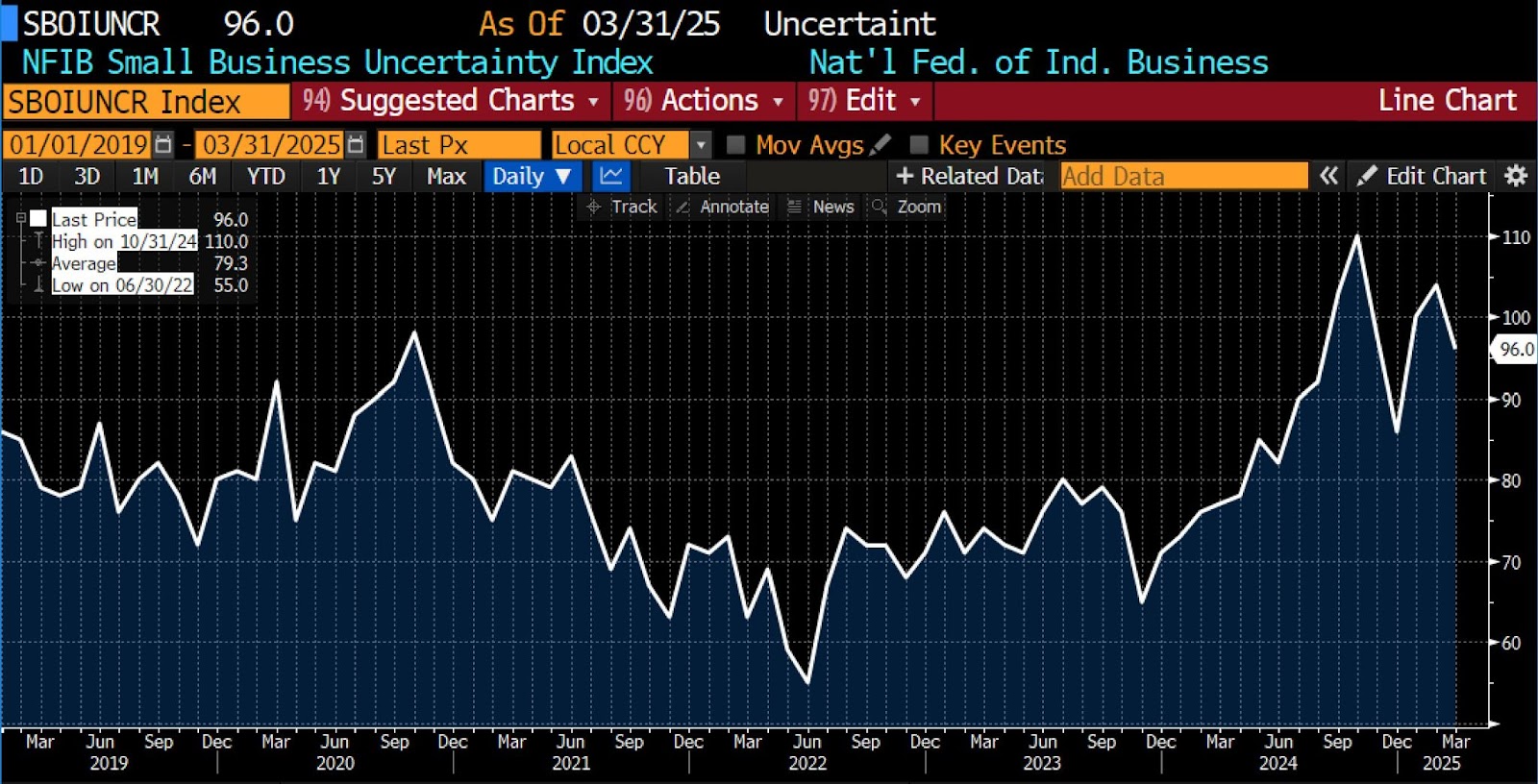

Transportation markets are signaling contraction. Truck sales declined sharply in March, while trucking demand is expected to drop significantly by the end of May as import volumes continue to fall. This will likely precipitate layoffs in the logistics sector, closely followed by job cuts in retail and manufacturing as firms recalibrate operations in response to declining sales. As was the case in the early stages of the COVID-19 pandemic, high policy uncertainty is prompting a freeze in both corporate investment and consumer spending. Small business optimism is approaching post-2008 lows, and consumer sentiment (as measured by the University of Michigan) has dropped to its lowest level in nearly three years.

From a macroeconomic perspective, trade-induced disruptions may already be weighing on GDP. The first quarter of 2025 saw a contraction — the first in three years — largely attributed to a ballooning trade deficit and frontloaded inventory building ahead of tariff announcements. Corporate earnings revisions have already turned sharply negative, especially for retail and consumer goods sectors.

The timeline for visible retail disruption is short. By late May or early June, consumers are likely to encounter out-of-stock conditions in key seasonal categories, including toys, back-to-school apparel, and holiday merchandise. Price tags will rise on others, particularly where supply has been disrupted and demand is relatively inelastic. The full impact will depend on both policy decisions and corporate strategy. If tariffs are softened or phased in more gradually, some supply gaps may be managed. But without such relief, summer could bring not only empty shelves, but also the start of a broader economic contraction.

NFIB Small Business Uncertainty Index, 2019 – present (Source: Bloomberg Finance, LP)

(Source: Bloomberg Finance, LP)

In the worst case, retailers who over-ordered in anticipation of demand could find themselves with late-arriving products mismatched to seasonal demand — a virtual replay of spring 2022, during which holiday goods arrived just in time for warm weather clearance sales. With consumer spending already showing signs of weakness, that type of mismatch could result in discounting, margin compression, and layoffs.

In short: even if a trade deal emerges in the coming months, the damage to supply chains and consumer confidence may already be done. Retailers may be forced to accept a leaner, less profitable, and more uncertain second half of 2025. And American citizens may find higher prices, fewer goods, falling variety, and declining employment opportunities. The first impacts of tariff-driven disruption are poised to arrive: some irreversibly, some not. There is still time to prevent the most serious consequences of imposing a tax on comparative advantage, and decoupling by fiat, but not much.