Berg Insight, the world’s leading IoT market research provider, today released new findings about the market for cellular routers and gateways.

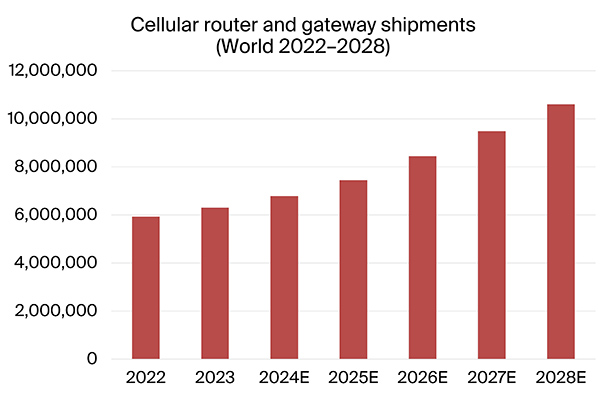

More than 6.3 million cellular routers and gateways were shipped globally during 2023, at a total market value of approximately US$ 1.6 billion. Annual sales grew at a rate of 3 percent year-on-year.

Reflecting trends in the broader enterprise network equipment market, growth was dampened by high inventory levels among customers and weaker demand in the industrial segment. Adjustments of inventory levels have partially extended into 2024. Until 2028, annual revenues from the sales of cellular routers and gateways are forecasted to grow at a compound annual growth rate (CAGR) of 12 percent to reach US$ 2.8 billion at the end of the forecast period.

While the industrial and transportation sectors remain significant end markets, there is an ongoing transformation in the demand for cellular routers and gateways. The shift is driven by enterprises seeking to ensure reliable connectivity and business continuity across distributed branches and other remote locations. High-speed 4G LTE technologies and 5G have made cellular a viable alternative to wired networks and cellular SD-WAN an increasingly mainstream choice among businesses.

Ericsson (formerly Cradlepoint) is the largest cellular router vendor globally. The company continues to invest heavily in its software capabilities and today offers a comprehensive portfolio of routers and adapters along with cellular-centric SD-WAN and security services. Teltonika Networks is the runner up and a dominant player in Europe with a growing international presence. Other vendors that hold significant market shares are Cisco, Semtech and Digi International. These five vendors generated US$ 796 million in combined annual revenues from the sales of cellular routers and gateways and hold a market share of 50 percent.

Other important vendors include BEC Technologies, Belden, Fortinet, Inseego, Lantronix and MultiTech in North America; Advantech, Four-Faith, Hongdian, InHand Networks, Moxa, Peplink and Robustel in Asia-Pacific; and Eurotech, HMS Networks, RAD and Westermo in the EMEA region. There is moreover a large number of small and medium sized vendors that hold meaningful positions in various regions and segments.

The post The cellular router and gateway market sees steady growth driven by enterprise demand and 5G adoption appeared first on IoT Business News.